Exactly How Livestock Danger Security (LRP) Insurance Can Safeguard Your Livestock Financial Investment

In the realm of animals investments, mitigating threats is critical to ensuring financial security and growth. Livestock Threat Protection (LRP) insurance coverage stands as a reliable guard versus the unpredictable nature of the marketplace, using a tactical approach to guarding your possessions. By diving into the complexities of LRP insurance policy and its complex advantages, livestock manufacturers can strengthen their investments with a layer of safety that transcends market fluctuations. As we discover the world of LRP insurance, its duty in securing animals financial investments ends up being progressively apparent, promising a course towards sustainable financial durability in an unstable sector.

Recognizing Animals Danger Defense (LRP) Insurance Coverage

Comprehending Livestock Danger Protection (LRP) Insurance coverage is important for animals manufacturers looking to alleviate financial risks connected with cost changes. LRP is a government subsidized insurance coverage product developed to protect manufacturers versus a drop in market costs. By supplying insurance coverage for market rate declines, LRP aids producers secure a flooring price for their animals, ensuring a minimal level of revenue despite market variations.

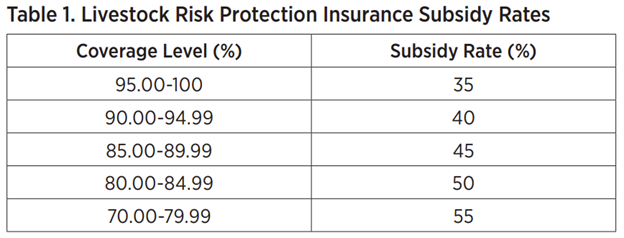

One key element of LRP is its versatility, allowing manufacturers to tailor coverage degrees and plan lengths to fit their details demands. Manufacturers can pick the number of head, weight range, protection price, and protection period that align with their production goals and take the chance of tolerance. Recognizing these customizable choices is critical for manufacturers to successfully manage their price threat direct exposure.

Furthermore, LRP is offered for various animals kinds, including cattle, swine, and lamb, making it a functional danger administration tool for animals manufacturers throughout different markets. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make informed choices to protect their financial investments and ensure financial stability in the face of market unpredictabilities

Benefits of LRP Insurance Coverage for Livestock Producers

Animals producers leveraging Livestock Threat Protection (LRP) Insurance coverage gain a critical advantage in protecting their investments from cost volatility and protecting a stable economic footing among market uncertainties. One essential advantage of LRP Insurance policy is rate security. By setting a floor on the cost of their animals, manufacturers can mitigate the threat of considerable monetary losses in case of market declines. This permits them to prepare their budget plans better and make informed decisions about their procedures without the consistent fear of rate changes.

In Addition, LRP Insurance policy provides manufacturers with tranquility of mind. Generally, the benefits of LRP Insurance policy for livestock manufacturers are considerable, supplying a beneficial device for handling threat and making sure monetary safety and security in an unforeseeable market setting.

Just How LRP Insurance Coverage Mitigates Market Dangers

Mitigating market risks, Livestock Risk Protection (LRP) Insurance coverage gives livestock producers with a dependable guard versus price volatility and monetary unpredictabilities. By providing security against unexpected cost declines, LRP Insurance helps producers secure their financial investments and keep monetary stability in the face of market changes. This sort of insurance enables animals producers to secure in a rate for their animals at the beginning of the plan period, making certain a minimum price level despite market modifications.

Steps to Secure Your Livestock Investment With LRP

In the world of agricultural danger administration, applying Livestock Threat Protection (LRP) Insurance includes a strategic procedure to safeguard investments versus market variations and uncertainties. To secure your animals financial investment effectively with LRP, the primary step is to examine the certain threats your operation encounters, such as rate volatility or unanticipated climate events. Understanding these dangers permits you to determine the coverage degree required to protect your investment effectively. Next, it is important to study and choose a credible insurance provider that supplies LRP plans tailored to your animals and business demands. Once you have actually selected a copyright, meticulously review the policy terms, problems, and insurance coverage restrictions to guarantee they line up with your threat monitoring objectives. Additionally, routinely checking market patterns and adjusting your coverage as needed can help maximize your security versus prospective losses. By complying with these actions vigilantly, you can boost the protection of your livestock investment and navigate market unpredictabilities with self-confidence.

Long-Term Financial Safety And Security With LRP Insurance Policy

Making certain withstanding financial stability via the utilization of Animals Danger Security (LRP) Insurance coverage is a sensible long-lasting strategy for agricultural manufacturers. By integrating LRP Insurance into their danger management plans, farmers can safeguard their livestock financial investments against unexpected market variations and unfavorable events that can jeopardize their economic health in time.

One key benefit of LRP Insurance policy for long-lasting financial protection is the comfort it offers. With a reliable insurance policy in position, farmers can mitigate the economic dangers connected with volatile market conditions and unanticipated losses because of factors such about his as illness break outs or natural disasters - Bagley Risk Management. This security enables producers to focus on the daily procedures of their animals business without consistent stress over prospective economic obstacles

In Addition, LRP Insurance supplies an organized method to managing threat over the long-term. By setting particular protection degrees and choosing suitable recommendation durations, farmers can tailor their insurance policy prepares to align with their economic objectives and run the risk of tolerance, ensuring a sustainable and safe and secure future for their livestock procedures. Finally, buying LRP Insurance is a positive method for agricultural manufacturers to achieve lasting monetary safety and shield their livelihoods.

Final Thought

In conclusion, Livestock Threat Defense (LRP) Insurance coverage is an important tool for livestock manufacturers to reduce market risks and safeguard their financial investments. It is a sensible selection for guarding livestock investments.

Comments on “Expert Assistance: Bagley Risk Management Strategies”